A bipartisan group of U.S. lawmakers re-introduced legislation aimed at clarifying how securities laws are applied to crypto tokens.

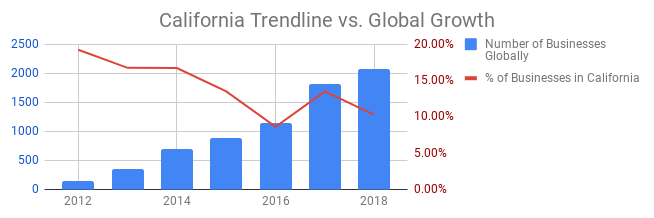

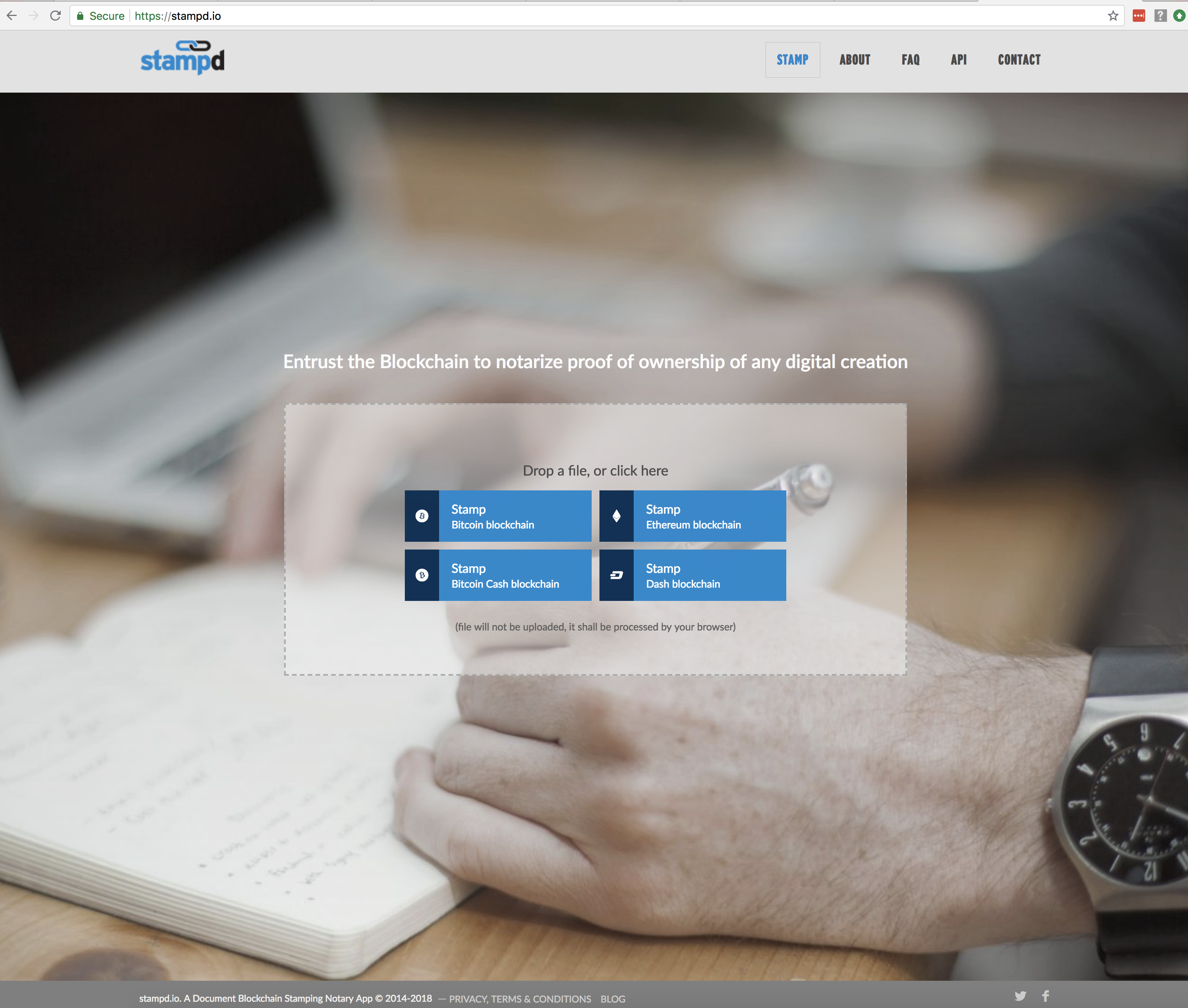

The Token Taxonomy Act of 2019, H.R. 2144, was introduced to provide regulatory certainty for businesses, entrepreneurs, and regulators in the U.S.’s blockchain economy. The proposed law would clarify the numerous conflicting state initiatives and regulatory rulings, and patchwork of judicial decisions, that have clouded certainty for entrepreneurs and businesses that use blockchain technology.

“The Token Taxonomy Act is the key to unlocking blockchain technology in America. Without it, the U.S. is surrendering its innovative origins and ownership of the digital economy to Europe and Asia. Passing this legislation, Congress would send a powerful message to innovators and investors around the world that the U.S. is the best destination for blockchain technology. In the early days of the internet, Congress passed legislation that provided certainty and resisted the temptation to over-regulate the market. Our intent is to achieve a similar win for America’s economy and for American leadership in this innovative space.

Ohio Republican Congressman Warren Davis

The legislation was written by Davidson (OH-08) and co-sponsored by Representatives Darren Soto (D-FL-09), Josh Gottheimer (D-NJ-05), Ted Budd (R-NC-13), Tulsi Gabbard (D-HI-02), and Scott Perry (R-PA-10).