Although new legislation is a step forward in recognition of the important of blockchain technology, regulatory uncertainty is harming innovation.

California has adopted two laws that promote the use and development of blockchain technology in an effort to maintain the state’s position as a leader in technology development.

One of the laws — AB 2658 — requires the formation of a working group to report to the legislature on the potential uses, risks and benefits of the use of blockchain technology by state government and California businesses. The report is due by July 1, 2020. The second law — SB 838 — enables companies incorporated in California to use blockchain technology to record the issuance and transfer of company stock. Gov. Jerry Brown signed the laws on Sept. 28.

Blockchain has the potential to revolutionize many industries in the near future. It is vital that California recognizes and supports this industry as an economic driver in our state. These are common sense bills that send the message that California supports innovation and the blockchain industry ….

Ally Medina, Director of the Blockchain Advocacy Coalition

What is blockchain technology? Blockchain is a digital ledger — a log of transactions. The ledger is shared across a network of computers, and transactions are recorded onto the ledger only if the computers on the blockchain network reach consensus on the validity of the transaction. Transactions are logged on the ledger as part of a block, and the blocks are strung together in a chain, with each including a reference to the preceding block – thus the name “blockchain.” It’s the same technology that powers Bitcoin and other “cryptocurrencies,” but, in part because transactions recorded on a blockchain are resistant to tampering, it is well-suited to tasks such as maintaining records of assets. If you’re interested in learning more, check out Blockchain Explained in 1000 Words.

The California laws, although they reflect a significant recognition by the legislature of the potential of blockchain technology, do not address many of the regulatory uncertainties surrounding certain implementations of blockchain.

For example, the U.S. Securities and Exchange Commission has not provided clear guidance on the circumstances under which cryptocurrencies will be subject to the same regulations as corporate stock. The Internal Revenue Service has not provided guidance about issues affecting owners of cryptocurrencies, such as how the tax law should treat owners of blockchain-based currency that has undergone a split called a “hard fork.”

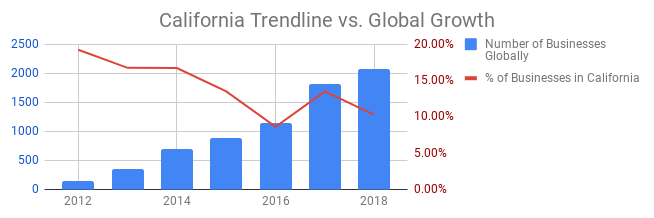

The lack of clear guidance from regulators threatens development of blockchain-related businesses in the United States, including in California, the center of so much of the innovation in the digital age. The Blockchain Advocacy Coalition published a chart showing how California is losing its global share of blockchain businesses.

Earlier this year, Perianne Boring, president and founder of the Chamber of Digital Commerce, an industry group, told The New York Times that the current regulatory landscape is “unorganized and incredibly complicated, and it’s really putting the U.S. at risk of falling behind from an innovation and technology perspective. There are turf wars between the different regulatory agencies and turf wars between the feds and the states, and none of this is in the best interest of the U.S. or the blockchain technology industry.”