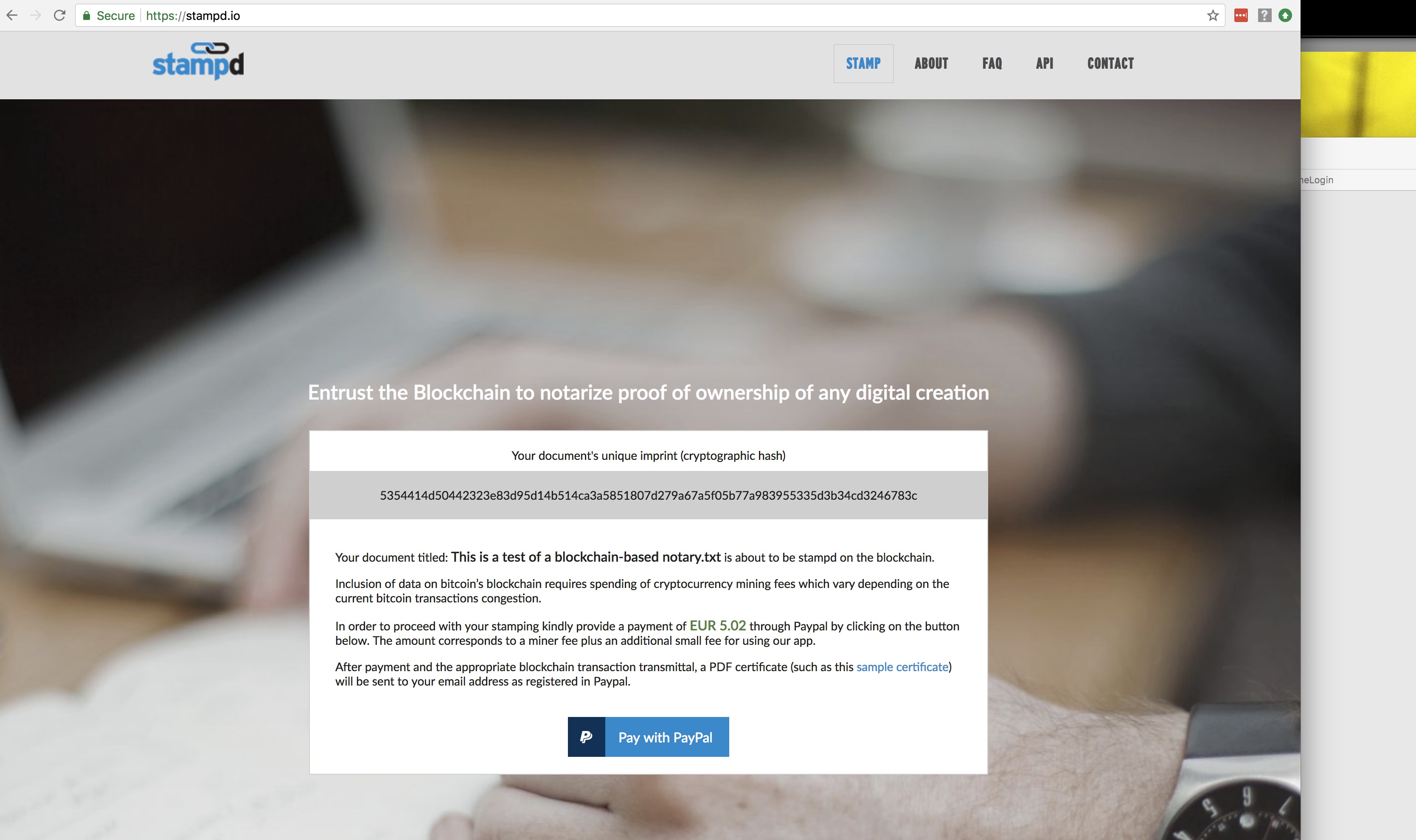

Starting Nov. 2, the State of Ohio will officially recognize electronic records that are generated or signed using blockchain technology.

Gov. Kasich signed SB220 , which amends the Ohio electronic transactions law in two ways: (1) “electronic records” are redefined to include a “record or contract that is secured through blockchain technology” and (2) “electronic signatures” are redefined to include a “signature that is secured through blockchain technology.”

“In Ohio, blockchain innovators can thrive in their efforts to develop new products and applications for the financial industry and beyond,” said Valentina Isakina, Financial Services Managing Director for JobsOhio, the private economic development corporation for Ohio. “Many companies looking to expand their blockchain and R&D operations are rapidly growing job creators, and Ohio is now even more attractive to these businesses.”

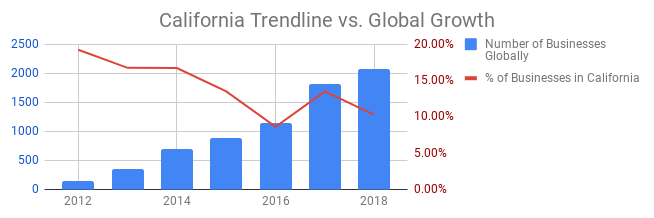

Ohio is one of 47 states that adopted what is known as the Uniform Electronic Transaction Act (also known as UETA). UETA is model legislation designed in the late 1990s, as the Internet was gaining mainstream adoption, to ensure that courts and state agencies would recognize transactions conducted digitally, rather than through paper contracts. Ohio joins three other states — Arizona, Nevada and Tennessee in amending its electronic transactions law to recognize blockchain-based transactions, according to a American Bar Association report. Two of the three states that have alternatives to UETA in place — Illinois and New York (Washington state is the third, in case you’re wondering) are considering amending their laws to recognize blockchain-based transactions. Florida and Nebraska also are considering amending their UETA statutes to recognize blockchain.

*The author expresses his sincere apologies to the fine state of Ohio (fine, not applying to its two professional football teams) for the allusion to Crosby, Stills, Nash & Young’s “Ohio,” which anachronistically played nightly on a mix tape in the newsroom of his college newspaper when he was a young journalist, long before blockchain, or the even the Internet, was really a thing.